Warren Buffett Sells More Bank of America Shares, Reaping $982 Million: A Deep Dive into the Transaction

Warren Buffett, the renowned investor and chairman of Berkshire Hathaway, has recently made headlines with his decision to sell a substantial portion of his shares in Bank of America (BofA). The transaction has seen Buffett reap an impressive $982 million, sparking interest and speculation in the financial world. This article will provide an in-depth analysis of this significant move, exploring the reasons behind the sale, its impact on both Berkshire Hathaway and Bank of America, and what it might signify for the future of Buffett’s investment strategy.Warren Buffett Sells More Bank of America Shares, Reaping $982 Million: A Deep Dive into the Transaction

1. Overview of the Transaction

Warren Buffett’s Berkshire Hathaway recently sold around 60 million shares of Bank of America, netting approximately $982 million. This sale reduces Berkshire Hathaway’s stake in BofA, which was previously one of its largest investments. The sale represents a notable shift in Buffett’s investment strategy and raises questions about his future moves in the banking sector and beyond.

2. Background on Warren Buffett’s Investment in Bank of America

Warren Buffett first invested in Bank of America in 2011, during a period when the bank was struggling with the aftermath of the financial crisis. Buffett’s investment was crucial, as it came with a substantial commitment of $5 billion in preferred stock and warrants to purchase common shares at a later date. This investment helped stabilize the bank and provided Buffett with a significant stake in the company.

Over the years, Buffett’s investment in BofA has been highly profitable, reflecting the bank’s recovery and growth. At its peak, Berkshire Hathaway’s stake was one of the largest institutional holdings in Bank of America.

3. Reasons Behind the Sale

3.1. Portfolio Rebalancing

One possible reason for Buffett’s decision to sell BofA shares is portfolio rebalancing. Buffett is known for his strategic approach to investing, often adjusting his portfolio to maintain balance and capitalize on emerging opportunities. By selling a portion of BofA shares, Buffett may be repositioning Berkshire Hathaway’s investment portfolio to focus on other high-growth sectors or opportunities.

3.2. Market Conditions and Valuation

The decision to sell may also be influenced by current market conditions and the valuation of Bank of America shares. With BofA’s stock price reaching significant highs, Buffett might have decided that it was an opportune moment to realize gains. The sale could reflect a belief that the stock has reached or exceeded its fair value, prompting a move to lock in profits.

3.3. Shifts in Investment Strategy

Warren Buffett’s investment philosophy has evolved over the years. Recent moves suggest a broader diversification strategy, potentially shifting focus from traditional banking investments to technology and other high-growth areas. The sale of BofA shares could be part of a larger strategy to diversify Berkshire Hathaway’s portfolio.

4. Impact on Bank of America

The sale of a significant number of shares by one of its largest institutional investors has several implications for Bank of America:

Stock Price Impact: Large transactions can sometimes influence a company’s stock price. Although BofA’s stock price may experience short-term volatility, its long-term performance will likely be influenced by broader market trends and the bank’s financial health.

Investor Sentiment: Buffett’s sale could affect investor sentiment. While it might lead to concerns about the bank’s future, it could also prompt a reassessment of its value and opportunities for other investors.

5. Berkshire Hathaway’s Position and Strategy

Berkshire Hathaway’s decision to reduce its stake in Bank of America reflects its broader investment strategy:

Diversification: Berkshire Hathaway is known for its diverse portfolio, which spans various sectors, including insurance, utilities, and consumer goods. The sale of BofA shares may be part of a strategy to diversify further into new sectors or investment opportunities.

Cash Reserves: The $982 million from the sale adds to Berkshire Hathaway’s cash reserves, providing the company with more flexibility for future investments or acquisitions.

6. Future Outlook for Bank of America

Despite the sale by Buffett, Bank of America remains a major player in the financial sector. Key factors influencing its future include:

Economic Conditions: The performance of banks is closely tied to economic conditions. As the economy evolves, BofA’s strategies and performance will adapt to new challenges and opportunities.

Regulatory Environment: Changes in financial regulations can impact banking operations. Bank of America’s ability to navigate regulatory changes will play a role in its future success.

Innovation and Technology: Investment in technology and innovation will be crucial for BofA’s growth. The bank’s ability to adapt to digital transformation will influence its competitive position.

7.Implications for Investors

For investors, Warren Buffett’s sale of BofA shares offers several insights:

Timing and Valuation: The sale highlights the importance of timing and valuation in investment decisions. Investors should consider market conditions and valuations when making investment choices.Warren Buffett Sells More Bank of America Shares, Reaping $982 Million

Long-Term Strategy: Buffett’s moves often reflect long-term strategies. While the sale may prompt short-term speculation, it is essential to evaluate the broader context and potential long-term benefits.

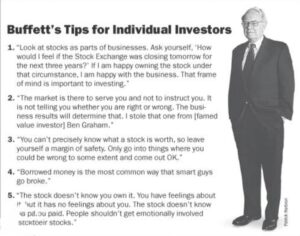

8. Warren Buffett’s Investment Philosophy

Warren Buffett’s investment philosophy centers around value investing, focusing on companies with strong fundamentals and long-term growth potential. His decisions, including the sale of BofA shares, align with his broader approach of making strategic adjustments to maximize returns.

9.Key Takeaways

Strategic Adjustments: Buffett’s sale of BofA shares reflects strategic adjustments in response to market conditions and investment opportunities.

Portfolio Management: Effective portfolio management involves balancing investments and capitalizing on emerging opportunities.

Investor Perspectives: Understanding the rationale behind major investment moves provides valuable insights for individual investors.

Warren Buffett Sells More Bank of America Shares, Reaping $982 Million

Warren Buffett’s recent decision to sell a significant portion of his Bank of America shares, resulting in $982 million in proceeds, is a noteworthy event in the financial world. This move reflects his strategic approach to portfolio management and market conditions. While the sale prompts speculation about its implications, it also offers valuable lessons for investors and highlights the evolving nature of investment strategies.

Warren Buffett, Bank of America Shares, Berkshire Hathaway, Investment Strategy, Market News

Hi there! Do you know if they make any plugins to help with Search

Engine Optimization? I’m trying to get my blog to rank for some

targeted keywords but I’m not seeing very good results.

If you know of any please share. Thanks! You can read similar blog here: Eco bij